First of all—congratulations!

If you are reading this post, that means you are at least thinking about expanding your practice and forming a group, which hopefully means you have a successful group practice or maybe just big dreams!

For the sake of this blog post, I am going to assume that you are in a solo practice with a sole proprietor EIN and have individual contracts with insurance companies.

Here are the steps you should take when expanding from a solo practice to a group practice:

1. Prep work

- Decide what type of business entity you want to form

- LLC/PLLC, S-Corp etc.

- This might include speaking with a lawyer or accountant on which business structure works best for you

- Obtain an NPI 2

- Can get one here (the same as your NPI 1).

- This will be the NPI for your group/organization and is needed for billing.

- Get a new business bank account for your new group practice/entity

- Add your new group practice as a new practice location on CAQH and re-attest

2. Contact insurance companies:

- This will most likely be your network representative or provider relations

- Express that you are expanding to a group practice and would like a group contract.

- Give them your sole prop EIN

- Some insurance companies do not allow for group contracts unless you have a certain number of clinicians. In that case, you will just be changing your tax ID to your new LLC/S-Corp

3. You will get sent group contracts and most likely group rosters.

- List yourself as a clinician on the group rosters

- Use your organizational NPI and your new group EIN

- If you already have clinicians you are ready to credential, you would also add them to your roster.

4. While waiting for your new group contracts to be executed, you can still bill under your sole prop EIN as usual.

5. Once the contracts are executed, be mindful of the effective date.

- Any date of service, on the effective date or after can be submitted under the new group EIN.

6. Sign up for electronic funds deposit/EFT using your new group practice bank account.

7. Billing as a group practice:

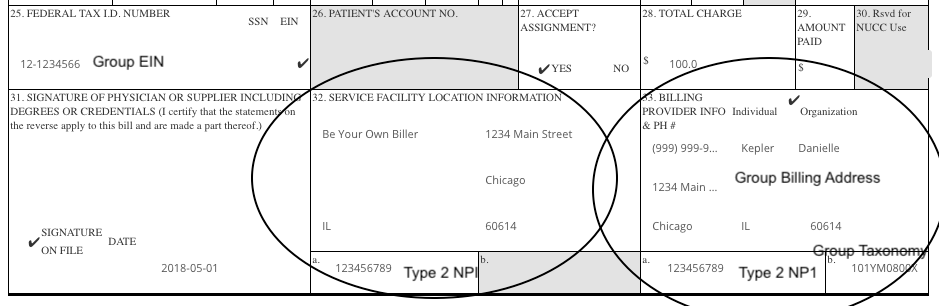

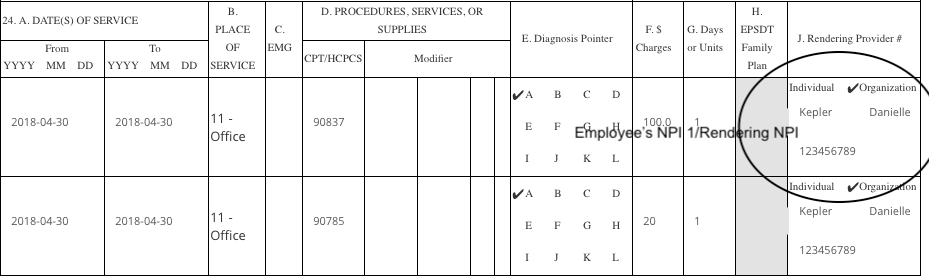

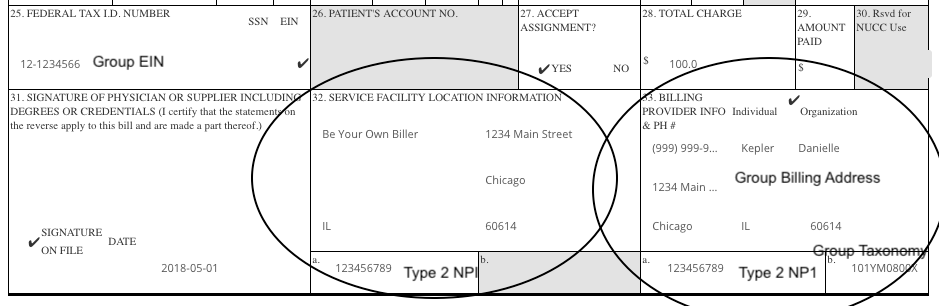

- Essentially the same, except in Box 32a and 33a you are putting your NPI 2

- In Box 33 you are checking ‘organization’ putting your group practice information.

- You are also using your NEW group practice EIN in box 25

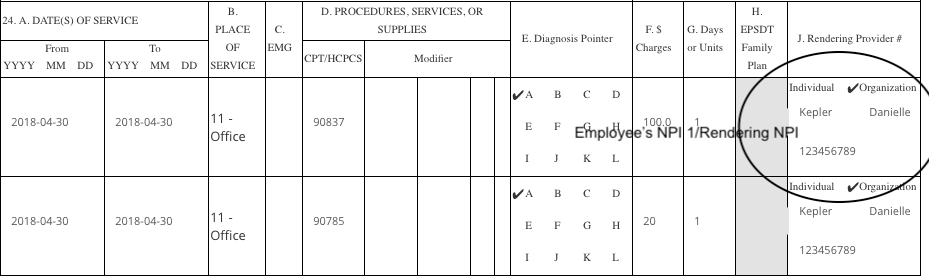

Employee’s NPI 1 in Box 24J

Type 2 NPI in Box 32a and 33a and Group Billing/EIN. Group name/billing address in box 33 and check Organization.

If the insurance company does not allow group contracts, you may have to continue to bill under your NPI 1 but with your group practice EIN.

Stay tuned for my next blog post about adding clinicians to your group practice contracts.