Here are some tips to ease out of network billing confusion:

What/Who is Out Of Network?

- Clinicians who have not signed a contract with an insurance company and do not have to abide by a contracted rate.

- Can still be subject to insurance audits for medical necessity and are still considered a HIPAA-covered entity.

- Some plans may not have out of network benefits at all.

- Never guarantee a client that they will get reimbursed for seeing you out of network.

- Usually, OON has very high deductibles which means the client (or you) would not get reimbursed until the deductible is met.

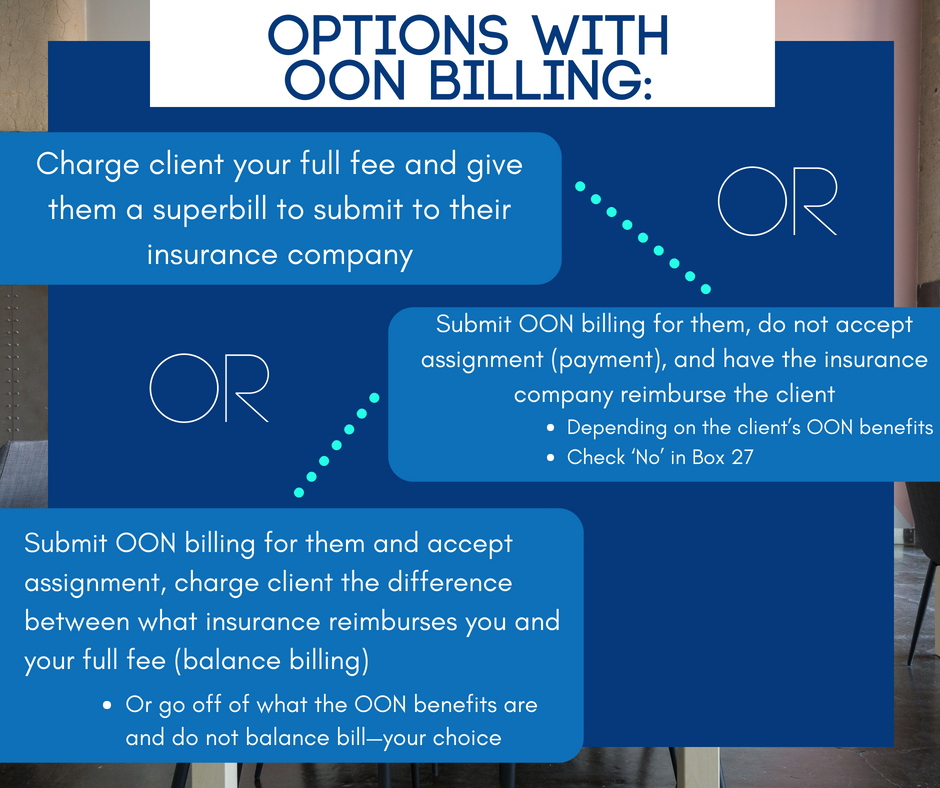

Options with OON billing:

- Charge client your full fee and give them a superbill to submit to their insurance company (Recommended!)

- Submit OON billing for them, do not accept assignment (payment), and have the insurance company reimburse the client

- Depending on the client’s OON benefits

- Check ‘No’ in Box 27

- Submit OON billing for them and accept assignment, charge client the difference between what insurance reimburses you and your full fee (balance billing)

- Or go off of what the OON benefits are and do not balance bill—your choice

Superbill

- Itemized bill given to clients to submit to their insurance company for payment

- Can only do this if you are OON

- Has the same information that is on a claim form including:

- Client’s demographic information

- Insurance information, date of birth, address

- Your EIN/NPI/License Number

- The client’s diagnosis

- CPT code and description

- What you are charging insurance and what the client paid you

- Client’s demographic information

Usual Customary and Reasonable Rate

- Think of it like an unofficial out of network rate (without a contract)

- Established to protect insurance companies from paying at the mercy of whatever providers charged

- Insurance companies take an average of each CPT code billed by providers with the same licensure level in your region to determine UCR

- This is why you should bill your full fee to insurance companies.

- Works like a contracted rate, but you can balance bill

- Example A:

- Client has an OON deductible of $2,000 and the UCR is $100

- You bill the client and the insurance company $150

- The insurance company only applies $100 towards the deductible, but you can charge the client higher than the UCR due to not being in-network.

- This is called ‘balance billing’ and is acceptable to do due to being OON and not having a contract with the insurance company. This is a contract violation if in-network as you have to collect your contracted rate and cannot balance bill.

- Example B:

- Client has met their OON deductible and insurance is paying 80% co-insurance, UCR is $100

- You bill the client and give the client a superbill with a $150 charge on it

- The insurance company reimburses the client $80 (based off of the UCR and not what you billed the client).